CKBlog: The Market

Wednesday, January 22, 2020

Netflix and Chill

by Steve Haberstroh, Partner

Netflix was up 4,181% during the 2010s. It was the best performing stock in the S&P 500 Index.

Can you imagine owning it the entire time? I can’t. Would you have forecasted its streaming growth back when the company was schlepping DVDs in the mail? Did streaming even exist back then? If you were smart (lucky) enough to buy the stock in 2010, would you have held on?

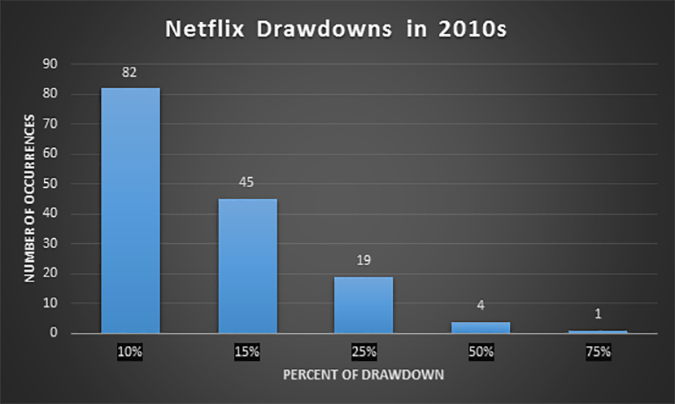

Just look at what an investor would have experienced to earn such a return:

Source: Bloomberg & CastleKeep

Yes, you are reading that right. In addition to seeing your investment drop by 10% 82 times, you would have to endure 45 sell-offs of 15%, 19 sell-offs of 25% or more, lose half of your money four times, and even see your Netflix investment drop by more than 78.62% from peak to trough in roughly four months.

In 2011 alone, when it decided to spin off it’s DVD business, Netflix stock dropped by 50% three times and 75% once.

Even Netflix founder and CEO, Reed Hastings, sold 5,000 shares 38 times that year totaling over $1.5 billion!

(Each red icon below is a 5000 share sale in 2011.)

Source: Bloomberg

So when you see the juicy headlines regarding stocks that returned literally thousands of percent in last decade, understand that earning such a return is nearly impossible for most humans.

It wasn’t that easy to just own Netflix and Chill ...