CKBlog: The Market

Friday, January 10, 2020

Look Out for Outlooks 2020 Edition

by Steve Haberstroh, Partner

It’s that time of year again where strategists are paraded on TV to share their predictions for the market in 2020. Ignore them. For the last three years I have documented their accuracy. And while these folks are no doubt brilliant and have access to the world’s best analysts, economists, mathematicians, and research, their predictions (guesses) have, on average, missed the mark by a wide margin.

To be fair, the task is virtually impossible. The S&P 500 Index is made up of 500 US companies that sell goods and services all over the world. The CEOs of these companies have a very hard time projecting their earnings one year out. Strategists, using their bank’s research and taking comments by company CEOs into account, then have to correctly predict how stock market participants will value those earnings. Even if they were certain about company earnings one year into the future, they’d then have to know how investors would react to earnings in light of the interest rate environment, global economic factors, and geopolitical events (plus about a million other inputs).

Consider the S&P 500 Index climbed roughly 30% in 2019 despite:

- Trade “War” with China.

- Yield Curve Inversion. (See “Don’t Let The Inverted Yield Curve Invert Your Investment Plan” )

- Continued recession fears.

- Lackluster IPOs from the likes of Uber and Lyft.

- WeWork pulling their IPO and 80% valuation write-down (in days).

- House impeachment of President Trump.

- Middle East tensions.

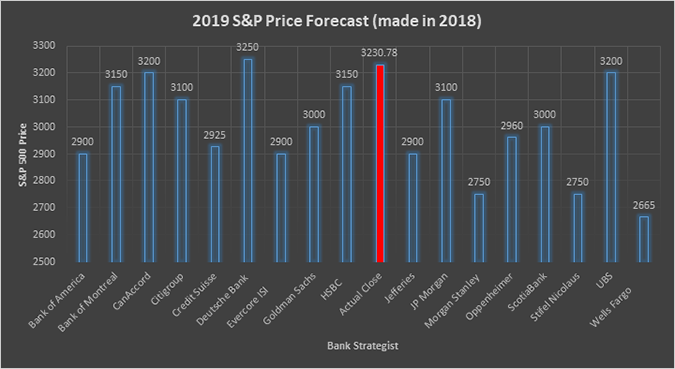

So how did these Wall Street Wizards do last year? Thankfully, Bloomberg keeps track of historical predictions. The chart below, sourced from Bloomberg, depicts these predictions of strategists back in December 2018 for where the S&P 500 Index would close on December 31, 2019. In red is where it actually closed.

The S&P 500 Index closed at 3,230.78.

The best guess was 3,250 from Deutsche Bank (they were less than 1% below the mark).

The worst guess was 2,665 from Wells Fargo (21% below the mark).

The mean of guesses was 2,994 (8% below the mark).

The median was 3,000 (8% below the mark).

Congrats to the strategists at Deutsche Bank, CanAccord, and UBS for coming within 1%. But I’d ascribe this to luck. Last year Deutsche Bank was off by 14%, CanAccord was off by 19%, and UBS off by 15%. They were off by 11%, 14%, and 16% respectively the year prior.

Interesting to note that strategists may be getting better at this collectively. This is the third year I have published the results.

Average predictions for 2017 were off by 14%.

Average predictions for 2018 were off by 12.8%.

Average predictions for 2019 were off by 8%.

Will strategists get it right in 2020? I wouldn’t bet your investments on it.

Note:

2019 Edition

2018 Edition