CKBlog: The Market

Friday, October 17, 2025

It Took Silver 45 Years to Recover

by Steve Haberstroh, Partner

It’s 1980. Nelson, William and Lamar Hunt, collectively known as The Hunt Brothers, are concerned about inflation and the destruction of the US dollar. They begin hoarding silver. Using leverage and futures contracts, they reportedly amassed a position worth several billion dollars. As news spread, a mania ensued. Silver had been used in collectibles and industrial products but until the Hunt Brothers sparked a frenzy, it had not been viewed as a speculative asset. Partly due to their efforts, the price of silver rose from below $7 per ounce in early 1979 to over $50 per ounce in early 1980—a near ten-fold increase in a matter of months.

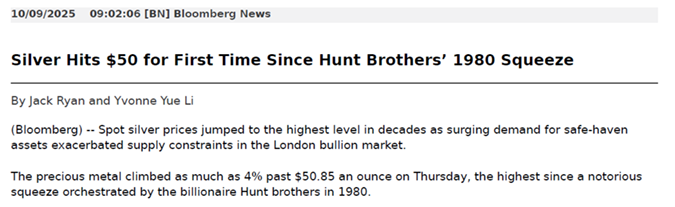

What followed was a classic example of a bursting bubble sparked by concern the Hunt Brothers could not meet margin calls on their loans. As the above chart from Bloomberg demonstrates, the price of silver collapsed from over $50 per ounce to less than $5 an ounce within days of its peak. Those who bought into the frenzy late ended up losing over 90% (assuming no leverage).

The price of silver languished for decades until renewed speculative interest in 2011—more than 30 years after The Hunt Brothers collapse. It was only this month, 45 years after last seeing $50 ounce, that silver bugs could celebrate new all-time highs.

Let that sink in. It took almost a half of a century for certain speculators in silver to recoup their losses. And this doesn’t factor in the impact of inflation. When you adjust for inflation, an ounce of silver is still more than 75% below its purchasing power in 1980.

Renewed Interest

So what has sparked the renewed interest in silver and other commodities? Most pundits point to the lack of fiscal discipline globally resulting in the debasement of currencies. Some investors are choosing physical metals over paper tender. Inflation persists. Whether its real estate, gold, silver or bitcoin, the price of scarce assets has been soaring. Along with it the coverage in financial media. Anecdotally, we’ve been fielding more calls and emails asking about silver, gold, and crypto.

This is normal behavior. Investors usually become more interested after historic runs higher.

Last week, Charlie Haberstroh, our Founder and CIO, shared an article from Bloomberg about silver’s long journey back to all-time highs.

Reading it prompted me to respond “I doubt anyone my age (43) could wrap their head around this. The price of a seemingly ‘safe’ commodity or scarce asset could be driven up so high due to speculation that its collapse could then take decades to recover from.”

It wasn’t just silver. Gold also peaked in the early 1980s and didn’t hit new all-time highs until 2007. When speculation, leverage and manic activity surround a scarce asset, such collapses are more often the norm. Tulips, railroads, silver, gold, oil, baseball cards, dotcom stocks, Beanie Babies (!), and crypto-related “assets” have all succumb to these phenomena.

The assets may be different. But human nature doesn’t deviate.

Charlie lived and worked through the silver peak in 1980 while an officer in the Commodity Finance Division at Chase Manhattan Bank. At that time, Chase was the largest bank dealing with commodity traders and hedgers. I asked him to describe the environment.

“Like today, there was a squeeze on silver bars and we were processing about one billion dollars of margin loans to protect our clients who had hedged their gold and silver positions. Like now there was urgent physical transfers from NYC to London of silver bars to meet delivery mandates.

“All of us in the division dropped everything else we were doing to handle the chaos. At that time, one way we dampened the speculative craze and ensured there was sufficient liquidity in the system was to require our clients to make same day margin calls, rather than next day as required by the exchanges.

“Oddly enough, our primary concern other than liquidity was to make sure that our clients continued to hedge their positions. Imagine lifting your hedge at the top of the market only to suffer losses as the market dove from $50 per ounce to $5 per ounce in a matter of days?”

He continued, “While my primary clients were institutional operators, we were aware that speculation didn’t end there. Mom and pop investors got in too ... late.”

Charlie offered some takeaways for those of us who haven’t lived through a mania followed by a prolonged depression such as the one experienced by the 1980s vintage of gold and silver bugs.

The same speculators that fuel the upside can cause the destruction on the downside.

In the 1980s, it was the Hunt Brothers. In most manias, you can point to several of the largest players pushing narratives and investing market-moving dollars to support their trade. On the way up, they are lauded as geniuses who can accurately predict the future. Michael Saylor, Executive Chairman of Strategy Inc, whose primary business model is to simply own bitcoin is an example of today’s frenzy to own crypto.

As their position owned by these “icons” inflates, so too does their potential to borrow against their gains to buy more and more. If the largest players continue to buy they end up sucking most of the smaller sellers out of the room pushing prices ever higher.

When the trade goes against them, the pattern reverses. What fueled their ability to push prices higher is precisely what causes the most destruction. Just ask the Hunt Brothers.

Speculative markets tend to fall 2X as fast as they rise.

Leverage works both ways (more on this below). As the price of an asset supporting loans drops, banks get nervous. Credit tightens. Speculators are forced to sell to meet margin calls. Sellers then far outweigh buyers. What supported the trade unravels it.

It becomes very difficult to sell into a rapidly falling market. Selling begets selling. Just look at the decline on Silver after peaks on the chart earlier in the post.

The credit officer won’t call you to warn you they are about to call Lamar Hunt to force-liquidate his position. You won’t have time to get out unscathed.

The Rules May Change

Periods of mania set off alarm bells for regulators. Exchange operators may be forced to change the rules mid game. Many attributed the collapse of the Hunt Brothers to a regulatory change which limited the ability buy more silver on margin.

Just like the lending officer won’t call you before they force a liquidation, regulators aren’t going to tip you off to a rule change to help you get ahead of it.

Leverage Works Both Ways

Let’s say you were lucky enough to own $1 million worth of silver in 1979. Your position ballooned to, say $5 million, within a matter of months. Your friends then labeled you a genius leading you to believe you are a skilled trader who can accurately predict where prices would go next. Overconfident, you borrow $3 million to buy more silver, now amassing an $8 million position.

Just as it did for the Hunt brothers, silver drops by 50% in a matter of days. In simple terms and assuming no margin calls, what are you left with?

A $4 million position in silver.

A $3.0 million loan plus interest.

Resulting in a net position of less than $1.0 million.

Had you not borrowed the $3 million to increase your position, your $5 million position of silver would have been worth $2.5 million after the 50% drop.

The loan caused an additional $1.5 million loss.

Leverage works both ways.

Conclusion

I was born in 1982 so was not around as a professional to experience the silver mania like my father. I am fortunate to have him provide perspective.

I have, however, lost a bunch of money getting caught up in the baseball card craze of the early 1990s and dotcom stocks in the early 2000s while in college. I lived through the financial crisis as a professional.

I have witnessed bitcoin collapse by more than 75% four times in the last five years—only to recover to higher prices each time. Will the next sell-off be different? I don’t know.

But I do wonder when I hear the biggest crypto supporters tell me its scarcity and the insatiable demand means it’s the new “digital gold” or “digital silver”, do they understand what that could mean on the downside? Or is crypto somehow immune to human nature and prolonged depressions in price?

I am not calling for a collapse in crypto. Ownership should just be sized appropriately. I hope it continues to help people amass wealth. It has changed the lives of many of my friends.

But there are similarities when comparing silver’s (and gold’s) collapse in the 1980s and today.

Currently, there’s concern about the debasement of global currencies. Inflation has been elevated. Returns for crypto have been phenomenal. There is tremendous leverage in the system. Like the Hunt Brothers, there are several “whales” who have been lauded as crypto evangelists. They keep borrowing, buying, and convincing others to do the same.

Would they meet the same fate as the Hunt Brothers if we witness yet another collapse?

Is it possible that it might take decades to recover?

I have no ability to accurately predict the future. I have no exposure to crypto (neither long nor short). I just want to make sure younger investors consider what can and has happened to other scarce assets when they fall out of favor.

I was floored by the prospect of a commodity destroying value for over 40 years. I just had to write about it.

Steve Haberstroh

Partner

CastleKeep Investment Advisors LLC

PDF version of this post: It Took Silver 45 Years to Recover