CKBlog: The Market

Sunday, November 08, 2020

Election Reaction

by Steve Haberstroh, Partner

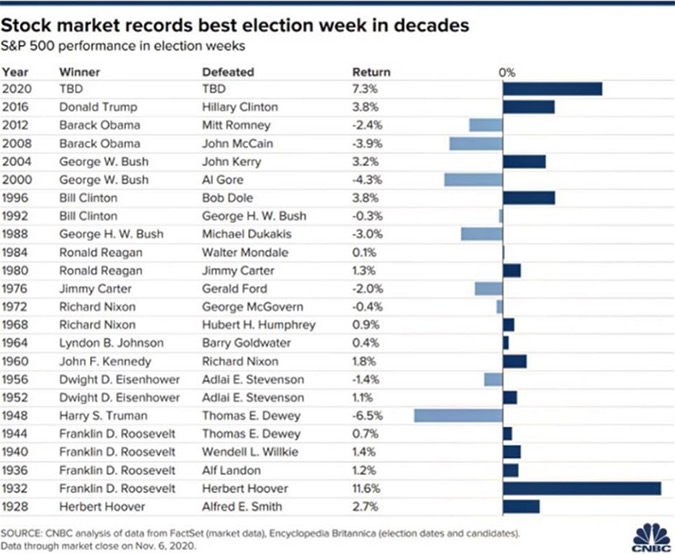

Record COVID-19 cases globally. A contested election. A potential Democrat sweep. What does the stock market do? It posts the best election week gain since 1932.

Note: The “TBD” references the fact that the Election had not been called when the chart went live on Nov. 6.

Which investing playbook would have correctly predicted this? How many people went to cash for one of the reasons above let alone all three of them in the same week? Short-term investing is so difficult. You can get it wrong even when you are right.

The point isn’t to throw your hands up in the air and give up. It’s to build out a framework that makes you comfortable and makes sense for your objectives ... and stick with it. It’s ok to make minor tweaks as the environment or your comfort level changes. But going to all cash or all stocks based on your emotions isn’t a recipe for success.

The elections have come and gone and while President Trump isn’t going down lightly, the country is moving on. If you were waiting for the resolution of this event to put cash to work, roll-over an old retirement plan, or sit down with your advisor, get to it. It won’t be long before another event might catch your attention and derail long-term plans.