CKBlog: The Market

Friday, October 16, 2020

Election Deflection

by Steve Haberstroh, Partner

Tensions surrounding the upcoming Presidential and Congressional elections are increasing. Add the political drama surrounding COVID and stimulus packages, it is no wonder investors are concerned. We’ve been hearing more of it, not just from TV but clients are reaching out too. One of our dearest clients recently asked how to protect the portfolio from a potential Civil War. Anxiety is real.

We’ve said time and time again that we have no ability to accurately predict election outcomes let alone how the market will react to such outcomes. But we are also sensitive to client concerns, so we’d like to spend some time discussing, without political theater, the environment surrounding the election.

Voting isn’t Trading

First, humans are great storytellers and it appears increasingly are becoming (or returning to) more tribal instincts. Watch MSNBC and you may hear another four years of President Trump will bankrupt our economy (if his actions or inactions don’t kill us first). Flip to Fox News and you will be told President Trump will propel our economy into the greatest four years the US has ever experienced. Both cannot be true.

Second, the stock market isn’t political. The market doesn’t operate in a voting booth; stocks are executed on a trading floor. Millions of transactions occur each day by thousands of people with varying political views. Thousands more don’t have political views or don’t have a stake in US elections, because they aren’t citizens of our country. Polls don’t equate to fund flows.

Third, let’s admit that every four years, we are told this Presidential election “is the most important of our lifetime.” That is ... until the next Presidential election.

In 2008, I remember being told then President Elect Obama was a socialist and would turn us into Cuba. “He’d be terrible for stocks!” was a common refrain. This from ABC News the day after the 2008 election:

In 2016, I was also told the market would drop by 50% should Candidate Trump be elected President. This was the CNBC headline:

Both Presidents experienced recessions. Both Presidents experienced painful corrections. Both fought wars, terrorism, poverty, and pandemics. Both were criticized. Both were celebrated. The US economy and the US stock market performed well under both Administrations.

This is nothing new. In fact, it turns out the US Economy and US stock market grow over time regardless of which party is in power.

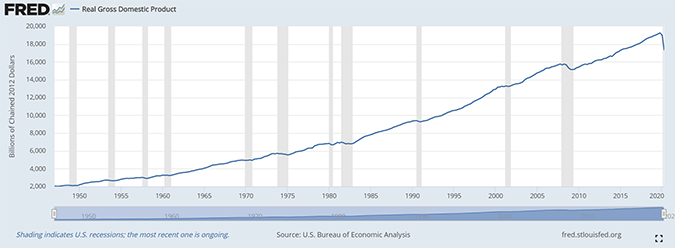

Below is the US GDP since 1947:

And here’s the growth of $1.00 invested in the S&P 500 Index since 1926. Seems like the market grew despite who was in power:

Short vs. Long

We aren’t blind to the fact that political headlines can move markets in the short-term. We are entering the most sensational period for political headlines—mere weeks from the election. Markets are volatile and unpredictable. For that reason, this period of time tends to be weak for the stock markets. History tells us that many investors seem to sit on the sidelines until an election is decided. This from Bank of America Merrill Lynch:

In presidential election years, September and October (red) average a negative return of 0.31% and 0.24%, respectively, but then tend to recover in November and December with more sizable gains. So rather than try and time this, why not just stay invested? Despite what the TV tells you, you don’t have to do anything with your investments.

Gridlock

If you are agnostic as to which President wins, what should you root for? A divided government. Turns out that’s the best recipe for stock market returns since 1928. The below is from Goldman Sachs:

Drill down further and the best combination for stock market returns has been a Democrat-controlled Senate, Republican-controlled House and a Democrat President. Second best? Republican Senate, Democrat House, and Republican President. This from Fortune and Strategas:

What behind this phenomenon? Likely a million things. However, a reasonable explanation is that a divided government usually results in a lot of banter but very little change. President Biden may want to increase taxes but a Republican Senate likely would stop him. President Trump may want to abolish “Obamacare” but good luck if the Democrats take the Senate.

Investors prefer it when the rules of the game don’t change. Status quo is bullish for stocks.

Blinders

Our best advice is to put on your blinders. Not the ones that will totally blind you, but the ones race horses use to focus on what is most important. For Secretariat it was the dirt right in front of him. For investors, it’s sending Peggy off to college without debt or celebrating your retirement. Save. Invest wisely. Spend more time in the market and less effort timing it. Imagine the absurdity of attributing your early retirement based on successfully predicting an election 20 years ago?

Built Ford Tough

I’d like to leave you with a little fun. When you think of the President who was best for the stock market, who comes to mind? Ronald Reagan? Bill Clinton?

Be honest, did you think Gerald Ford? I bet zero people voted for President Ford because he’d eventually boast the best stock market return (by a wide margin). But that’s what happened. Who could have predicted that?

Vote. Don’t trade.

Election Deflection (PDF)