CKBlog: The Market

Friday, April 20, 2018

Don’t Sleep on Non-US Stocks

by Steve Haberstroh, Partner

It’s November 11, 2004. My first day as a Financial Advisor for a major brokerage firm. I spent it in the mall.

That’s right. Coming off a degree in Economics from what I consider a top tier University and passing my Series 7 and Series 66, I show up excited for my first day of work. I’m greeted by my new managers and was given my first assignment. Read The Intelligent Investor by Ben Graham, the godfather of value investing? Pore over the latest Quarterly Earnings reports? Learn about tax efficient investing? Nope.

My assignment was to go to the South Shore Plaza in Braintree, MA, set up a folding table, and try to convince shoppers to meet with me to talk about their financial objectives. It got worse. I was also told to bring a spin wheel so folks could spin for various gifts cards redeemable if they offered me their phone number and email address. Can you imagine? “Step right up folks! Who wants to spin the wheel and retire early??!!” I was horrified. This can’t be. Financial Advisor Clown?

I asked my manager, “But what about investments? When do we learn about those?”

He responded, “Haberstroh, to manage money you need to have clients. How many clients do you have?”

“Zero, it’s my first day ... ” my sheepish reply.

“Exactly. Consider yourself lucky. We’ve got you down for a six-hour shift.”

Six hours?? Message received. Investments don’t matter ... yet. I need to get clients.

Modern Portfolio Theory

Eventually, I acquired clients. I really enjoyed the thrill of the “sale” and seemed to be reasonably good at it. After my first year, I took on 40 or so clients and had begun to build and actually invest their portfolios! To put client funds to work, I relied on the expertise of the firm and my managers who were several years older and therefore more “seasoned”. Everybody knows it only takes a couple years to master the markets!

To build portfolios, we used Dr. Markowitz’ Nobel Prize winning Modern Portfolio Theory (MPT) as our foundation. MPT tells us that 91% of an investors’ return is attributable to their asset allocation. According to this theory, it was more important to get the exposure to broader asset classes right (cash, stocks, bonds) than it is to buy the best performing funds or individual securities.

An overly simplified example of this is, over the long term, the person with a portfolio of 80% US stocks and 20% cash in a strong stock market should do better than another person who had 80% cash and 20% stocks even if the 20% of stocks were terrific performers. Simple enough, right?

It was also (and conveniently) a good sales technique to sell more of the firm’s propriety funds because, “it doesn’t really matter which fund you pick for your Large Cap Value allocation Mr. Smith. It’s the overall asset allocation that matters most!”

The dark side of selling all proprietary funds is for another blog post. But it turns out, Modern Portfolio Theory works well in practice. It diversifies portfolios and gives exposure to both the “in favor” and “out of favor” asset classes and sectors. I didn’t have to predict whether growth stocks would outperform value stocks or whether clients should be “overweight” international stocks or emerging market bonds. Clients would own a bit of everything and we’d rebalance from time to time, forcing us to trim our “winners” and use the proceeds to buy more of the “losers”. Buy low, sell high.

Dumb Luck

And as time went on and I met with clients throughout the first several years, a theme emerged. “I don’t know what you’re doing Steve, but we’ve never seen performance like this. Keep up the good work!” I had never been so proud of my Econ degree and was sure as ever that my reading of the Wall Street Journal each morning was paying off!

Wrong. Only in hindsight did I realize why clients were so impressed. I didn’t have a magic touch. My managers weren’t brilliant. Nor did the funds I was picking for each asset class outperform year after year. Turns out, because of Dr. Markowitz’ theory, this was the first time that many of these clients had exposure to non-US stocks and non-US bonds. And these asset classes were on fire!

Patriotic Investors to a Fault

It’s been well documented that most investors, including US investors, perennially succumb to “Home Country Bias”. US investors tend to invest in US stocks because these companies are familiar to them. Almost everybody knows what Facebook, Apple, Google, and John Deere do. But when asked to name top companies in Norway or Chile? Crickets. Plus who doesn’t want to root for the good ol’ USA? Unless working with a professional, investors tend to be very patriotic with their portfolio. And despite what we’ve experienced in the last nine years with the US stock market nearly quadrupling since its lows in 2009, it’s not always the best investment strategy to go all-in on the US.

I was reminded of this recently when I read a great piece by Larry Swedroe called Don’t Abandon International Diversification. I encourage you to read it here: https://www.advisorperspectives.com/articles/2018/04/16/dont-abandon-international-diversification

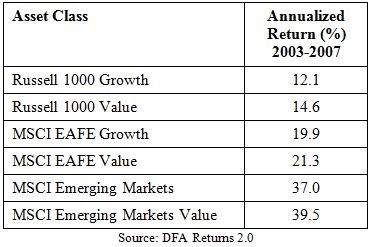

In his piece, the investment management veteran highlighted the outperformance of non-US stocks from 2003 and 2007. The purpose was to remind investors to not forget about non-US stocks. The chart below demonstrates the outperformance by non-US stocks from 2003 to 2007. Russell 1000 Growth and Value are US indices. MSCI EAFE represents the performance of stocks in 21 developed countries (not including the US). MSCI Emerging Markets represent stocks in, you guessed it, emerging markets like Brazil, Russia, China etc.

Remember that I started my career in 2004. That means my clients who had never really invested outside of the US were experiencing outstanding returns for the first time. Emerging market value stocks returned 39% per year for four years! As Swedroe notes, “The results in this period (2003-2007) were just the reverse of what they were in the period following it (2008-2017), with international stocks far outperforming U.S.”

I can also demonstrate this graphically. Below is a 20-year chart of the S&P 500 Index (SPX) and the MSCI World Index Ex US (MXWOU) ending March 31, 2018. The SPX is in orange and MXWOU in white. You can see the orange line is at its largest “outperformance” gap in 20 years:

I have no crystal ball so cannot tell you precisely when the white line will take over the orange line. But the point here is to 1. Maintain (or initiate) your non-US exposure despite its recent lag. 2. Always hire your financial advisor at the mall. (Just joking!)

Over the last 14 years in the business, with the help of my father (our CIO) and Lauren Quesada (our VP of Investments), and after observing/studying markets over time (and over lunch at the food court), one thing has become clear to me. Mean reversion is real and universal. Things that have been hot for a while tend to cool down. Likewise, things that have been out of favor eventually become the favorites. You earn the fruits of the good times by sticking through the bad times.

So while US stocks have been “winning” against the rest of the world for the last five years, remember that nothing lasts forever. Even six-hour mall shifts ...