CKBlog: The Market

Monday, February 12, 2024

But We’re at All-Time Highs

by Steve Haberstroh, Partner

Investing is difficult under most circumstances. When markets seem to be in free fall, fear can paralyze. When markets are at all-time highs, investors tend to be cautious about putting more capital to work. Have you caught yourself saying something like this recently?

I know I should invest more, but we’re at all-time highs ...

Rather than rely solely on feelings (importantly, we do not ignore them), we use our experience and historical data to try and answer whether it is perilous to invest when the markets are at all-time highs. For this post, we will rely heavily on the work of Ryan Detrick from Carson Investment Research who recently published a paper on the topic. Huge thanks to him and his team.

Their work and the source of all charts below can be found here: https://www.carsongroup.com/insights/blog/six-things-to-know-about-all-time-highs/

All-Time Highs Aren’t Scarce

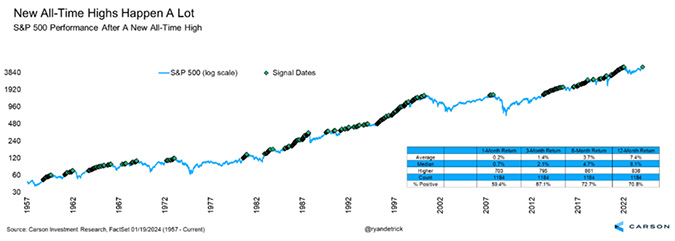

According to Detrick, since 1957 there have been 1,186 new all-time highs or 7% of all trading days. Said differently, we’ve experienced one new all-time high every 14 days the market has been open. Not that rare.

Intuitively, this makes sense. The slope of the S&P 500 Index moves up and to the right over the long-term, so it stands to reason that it has continued to make new highs. Sure, there are periods of real and prolonged pain, but when you look at the below chart, should you really be all that surprised or nervous about new highs? They seem to keep happening.

Black dots represent new all-time highs.

Source of Fear

So if all-time highs aren’t super scarce and the long-term trend is your friend, what’s the source of fear? Recall that humans have evolved principally because we are wired to recognize and run from danger—lions and bears can be dangerous in the wild (in markets too for the latter). So, it stands to reason humans tend to invest through a skeptical lens.

But it also stems from very real and prolonged pain investors have experienced on occasion shortly after hitting new highs. Many of you reading this post have lived through the brutality of 2007-2008 (Financial Crisis), 2000-2001 (aftermath of the Dotcom Bust), and Black Monday of 1987 (the Dow Jones dropped 23% in a single day!). If so, there’s little I can write to totally erase those memories.

But consider that in each of those cases, the market did eventually recover and did reach another new all-time high—it just took some time.

In 1987 it took almost two years.

In 2000 it took more than seven years.

In 2007 it took almost six and a half years.

Ok, so are you back to fearing today’s highs?

The human mind is fascinating, isn’t it? Since 1957 there have been more than eleven hundred all-time highs which beset newer and even higher all-time highs, but we humans tend to remember (and focus on) just three of the worst.

So What’s Next?

First, a disclaimer. Nobody, not even the wisest of investors can successfully predict the future. Past performance is also no guarantee of future results. So, despite what historical precedence may point to, this time may be drastically different than the past. But the past can be instructive to help frame your thinking.

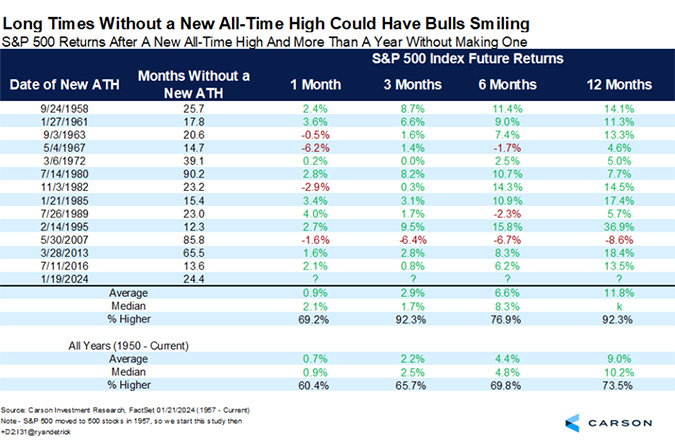

Since 1957, there have been twelve occurrences where the S&P 500 Index hit a new all-time high after not experiencing one for at least one year—this year’s occurrence is the thirteenth. One year later, in eleven of those occurrences, the market closed higher-for an average return of +11.8%. It’s true this is a small sample size and the pain of 2007 lasted longer than one year but the table below demonstrates that the mere presence of an all-time high does not absolutely require a substantial market sell-off in our near future. Think of those 1100+ occurrences!

Again, from Carson Investment Research:

Bottom Line

Fear lingers. It is difficult to shake. We cannot tell you with confidence that the market will not experience a meaningful sell-off from here. So, we wouldn’t be blindly advising to go “all in” on stocks today (or any day for that matter). But it is also important to recognize that all-time highs have historically leaned more bullish than bearish.

So check your fears and remind yourself why you are investing in the first place. The decision to commit more capital should be made after a holistic review of your situation and or in conjunction with an investment plan already set in place.

If you are still nervous about investing today at these levels, consider the following. Put yourself just before the major sell-offs of 1987, 2000, and 2007. You are sitting with $1 million of cash and are about to invest the entire sum into stocks. I can hear your past self saying, “But we are at all-time highs ... ”

If you talked yourself out of investing, you would have missed out on the following performance of stocks (S&P 500 Index including dividends) through today, February 12th, 2024:

+3,772.34% gain or +10.58% annualized from October 16th, 1987 (the Friday prior to Black Monday’s drop of -23%).

+462.33% gain or +7.48% annualized from March 9th, 2000 (market peak before Tech Bubble burst).

+348.02% gain or +9.60% annualized from October 8th, 2007 (all-time high before the Financial Crisis).

With the benefit of hindsight, which scenario would you prefer? Having remained in cash or suffered through periods of painful drawdowns while owning stocks only to build back to greater wealth?

I am not suggesting it is easy, but if you have a long-term time horizon, don’t let all-time highs deter you from building long-term wealth.

Steve Haberstroh, Partner

CastleKeep Investment Advisors LLC

February 12th, 2024

This article as a PDF file: But We’re at All-Time Highs