CKBlog: The Market

Tuesday, January 23, 2024

2023 Year in Review

by The CastleKeep Team

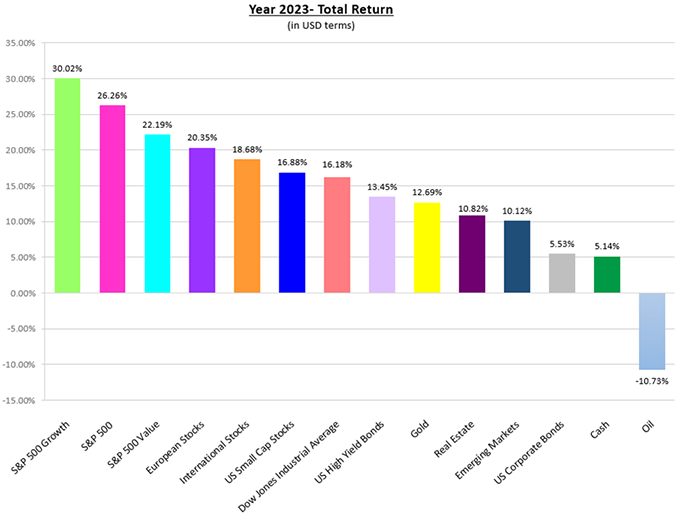

With all of this uncertainty, why wouldn’t I just hold cash and earn my 4ish percent with no risk?

If you rewind twelve months, this question seemed entirely reasonable. Investing in “risk” assets felt too risky at the time for many. It’s true that while equity markets carry risk, being out of the market for long-term oriented portfolios carries a different kind of risk—opportunity cost. 2023 was the perfect example of this. Have a look at the performance of major asset classes.

Source: Bloomberg LP.* The broad indexes represented in the graph are as follows: S&P 500 Index, S&P 500 Value Index, S&P 500 Growth Index, Dow Jones Industrial Average Index, US Small Caps: Russell 2000 Index, International Stocks: MSCI World Ex-US Index, European Stocks: MSCI Europe Index, Emerging Markets Stocks: MSCI Emerging Markets Index, Real Estate: FTSE NAREIT Developed Market Index, Gold: SPDR Gold Shares ETF (GLD), Oil: US WTI Crude Cushing Index, US Corporate Bonds: Bloomberg US Aggregate Total Return Index, US High Yield Bonds: Bloomberg US High Yield Total Return Index, Cash: Bloomberg Barclays US 1-3 Mo T-Bills. Data in US Dollar terms and as of December 31, 2023.

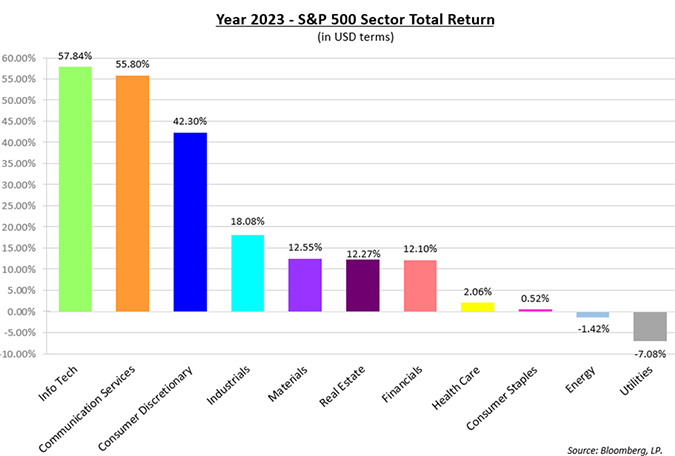

When you drill down to the sector level of the S&P 500 Index, a similar theme appears. 2023 was kind to investors exposed to equities across most segments of the market. The sectors which had struggled the most in 2022 were the stronger performers in 2023 (information technology and communication services). Energy and utilities were the only sectors with positive performance in 2022. Yet in 2023, oil- and gas-related companies along with utilities were the only sectors trading lower on the year. Below are the actual returns for 2023 by sector:

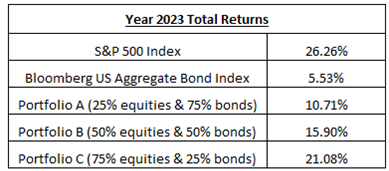

It’s true that earning roughly 4% from short-term US Treasury Bills, or better yet, a liquid money market fund sounded attractive twelve months ago, but as depicted above, investors who chose that option likely are feeling regret as they review the returns for even the most simplistic diversified portfolios in 2023. Suppose instead of earning the 4% on US T-Bills, you were offered portfolios that carried either 100%, 75%, 50%, 25% or 0% equities (S&P 500 Index) with the remainder invested in bonds (Bloomberg US Aggregate Bond Index):

Investors who chose the 4% “risk-free” return on US T-bills accepted the risk of not capturing the potential inflation beating returns that materialized in 2023. They also had that choice going into 2022 which would have protected them from a large drawdown. But would they have gotten back in to start 2023? We doubt it. And it certainly would be more difficult to do so today after witnessing the outstanding returns stock investors just experienced. The market is overpriced. I will get back in when it sells off ... . Seems intuitive, but when the market sells off, fear is abound making it difficult to get back in—remember twelve months ago?

It’s why we preach until we are blue in the face—build the right portfolio for your objectives and stick to it. Seems simple, but it can be extremely difficult to adhere to. That is why we’re here.

So, what caused a sharp run-up of stock prices in 2023? We are quick to point out that no single variable can explain the activities of global markets. However, we find it useful to cover several key themes.

Interest Rates

Often described as “gravity” for financial assets, a shift in interest rates will affect most securities. In simplistic terms, as interest rates rise, so do mortgage rates, car loans, business loans (which all tend to weaken the economy over time), but also the yields investors can earn on savings accounts and bonds. These higher yields compete with a stock investor’s dollars thereby potentially lowering demand for stocks.

When rates rise, demand for the longest duration assets are hit the most, all else being equal. It’s common sense. When interest rates are relatively high, investors have the choice of earning decent returns on conservative assets which earn cash returns today (cash, short-term bonds, equities with dividend yields) versus allocating dollars to investments that may take many years to deliver cash returns back to investors.

A classic example of this is the fall preceding the dramatic rise of the high-growth, technology related companies now known as the Magnificent Seven (more on the “Mag 7” later). These high growth companies were punished in 2022 as the market sniffed out the prospect of higher rates. The market had this right, as central bankers eventually raised benchmark rates around the globe in 2023. In the US, they did so at the fastest rate in 40 years! Longer duration assets then recovered in mid-to-late 2023 as investors came to terms with the fact that inflation, and therefore interest rate hikes may be behind us (no guarantee of course). See the action of the S&P 500 Growth Index for the two years ending December 31, 2023:

Consensus also came to terms with the fact that the US (and the globe) may perhaps be sporting a strong economy while defeating inflation.

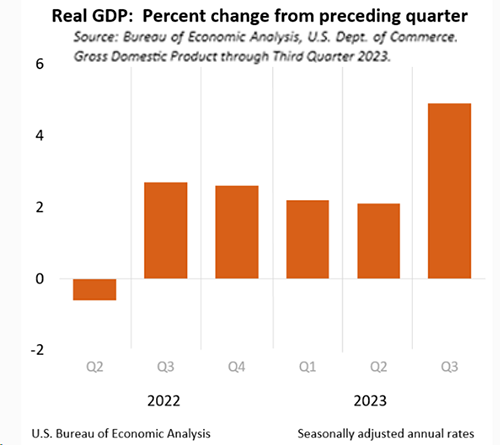

Recession Recessed

Prominent economists have been calling for a recession since the yield curve inversion nearly two years ago. These calls grew louder when the Fed began raising rates last year. In fact, at one point in 2022, Bloomberg Economics placed the odds of a recession for 2023 at 100%! Not only did the anticipated recession not materialize, but the US economy actually gained strength in 2023. Take a look at the quarterly GDP readings (net of inflation) for the US over the last six quarters:

The last two years have provided a stark reminder that making predictions about global macroeconomics is a fool’s game. Hence the old adage, “economists have successfully predicted nine of the last five recessions.”

The last two years have provided a stark reminder that making predictions about global macroeconomics is a fool’s game. Hence the old adage, “economists have successfully predicted nine of the last five recessions.”

According to recent data, global economies remain strong. Economists are now (again) warming up to the idea of a soft landing. But nothing lasts forever, so do not be surprised if the pundits are wrong yet again. Economies are cyclical. Recessions are normal. In fact, according to the National Bureau of Economic Research, the body responsible for official declarations of US recessions, there have been 34 since our country’s founding. All the while, the US has grown to be the largest, most dynamic economy in the world.

Oil

Speaking of predictions that went awry in 2023, WTI Crude, the US reference price for oil, closed 2022 at $80.26 per barrel. It closed 2023 at $71.65—a drop of more than 10%. This is despite the ongoing war in Ukraine and the attacks on Israelis by Hamas and the resultant reprisals. Professional traders and Wall Streeters alike would not have guessed oil prices would drop while escalations of conflict occurred in the Ukraine and in the Middle East.

As a result, see the chart of the average gas price in the US during 2023:

Like the price of oil, prices at the pump are lower today than at the start of 2023 and are off by more than 15% from their September highs, further buoying the average US consumers’ purchasing power.

INVESTMENT THEMES OF NOTE

Banks:

The first half of 2023 witnessed the second (First Republic), third (Silicon Valley Bank) and fourth (Signature Bank) largest banking collapses by assets in US history. Concerns of contagium permeated markets as so-called “experts” offered up their predictions on which bank was next to fail. Shares of the SPDR S&P Bank Index ETF (ticker: KBE) dropped more than 35% peak to trough. At the lows, investors could have snapped up banks for less than the value of bank assets held on their balance sheet (known as book value). As concerns abated, the economy remained resilient, and more recently, interest rates on the US 10-Year Treasury Note have fallen, KBE has erased its paper losses incurred earlier in the year and finished 2023 up over 5%.

Much of the concern regarding certain banks earlier in the year stemmed from their exposure to longer-dated bonds held on their balance sheets. When interest rates rise, bond prices fall, all else being equal. Longer-dated bonds tend to fall the most—recall the longer duration asset discussion earlier in this letter. Why hold onto the 10-year bond you bought in 2021 that carries a coupon of 2% when newly issued bonds are paying 4% today? Prices must adjust.

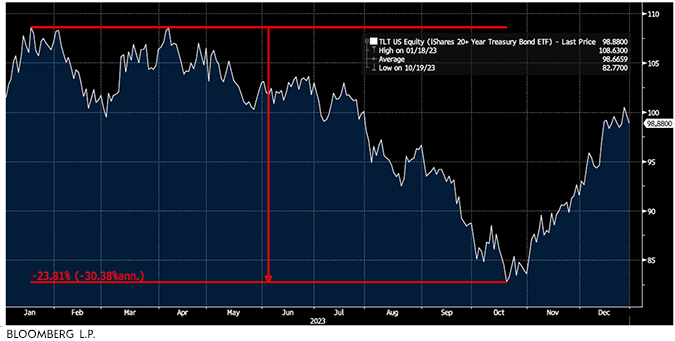

Banks weren’t the only bondholders to be negatively impacted by the rise in interest rates. If your portfolio held longer dated bonds, you too suffered steep paper losses heading into the end of the summer. Look at the price action of the iShares 20+ Year US Treasury ETF (ticker: TLT) during 2023:

What is normally viewed as a ballast for portfolios resulted in increased negative volatility (and pain through September prior to their year-end rally). This caught bond investors off guard in 2022 and continued for the better part of 2023.

It wasn’t all bad news for fixed income securities, however. Bonds and debt instruments carrying floating rates performed far better for investors in 2023.

Business Development Companies (BDCs) and Floating Rate Funds:

This is perhaps why pensions, endowments, and wealth managers have been allocating fixed income exposure to middle market lenders, also known as Private Credit, at the fastest pace in history. These loans were traditionally made by banks, but due to increased regulations most banks have exited this business in the years after the 2008 Financial Crisis. Private lenders and private equity firms stepped in to fill this void by offering debt instruments that are typically senior, secured by assets, and carry floating interest rates. As interest rates moved higher in 2023, so did the coupon that investors received for owning these instruments—a stark contrast to longer duration bonds carrying fixed coupons.

As a result, investors (institutional, accredited, and retail alike) now have access to the potential returns offered by loans to large, privately held companies—often backed by top quartile private equity firms which own equity in the companies. Because these borrowers aren’t large enough to issue publicly traded bonds, interest rates on these loans are typically well in excess of the average yield for traditional fixed-rate corporate bonds. These loans are commonly priced at SOFR (Secured Overnight Financing Rate) plus 5%. If the underlying companies can ultimately repay these loans, end investors may experience 8-12% returns [because SOFR today is priced above 5%]. No guarantees of course.

Thorough due diligence is critical for investors considering this growing asset class as there are many new entrants launching their first funds with little experience. There will be defaults, so investing alongside veteran underwriters who have experience in loan workouts is key.

Magnificent Seven:

It’s been widely reported that the so-called “Magnificent Seven” (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) are solely responsible for propelling the market higher. Given the sheer size of these companies, their impact on the performance of the market cap weighted S&P 500 Index is inevitable. In 2023, this influence helped the S&P 500 Index surge by more than 26% including dividends (the opposite return of 2022).

2023 Total Return for the Magnificent Seven stocks (including dividends):

![]()

[Interesting fact: Berkshire Hathaway, not considered one of the “Mag 7,” ended the year with a slightly higher market cap than Tesla.]

It’s true that the Mag 7 performance has been stellar and as a result, many feel that the market is “expensive.” But what about the other 493 stocks out of the 500? The equal weighted S&P 500 Index, where each constituent has an equal weighting thereby neutralizing the Magnificent Seven’s impact on the market capitalization weighted S&P 500 Index, also climbed 13.70% including dividends in 2023 with more than half of its constituents climbing by more than 10% for the year. In fact, 349 of the 500 companies had positive returns in 2023. For investors concerned that the “market is too expensive” the equal weighted index sports a less lofty forward P/E of 16.73 compared to 21.76 for the market cap weighted S&P 500 Index at year end.

THEMES FOR 2024

Presidential Election:

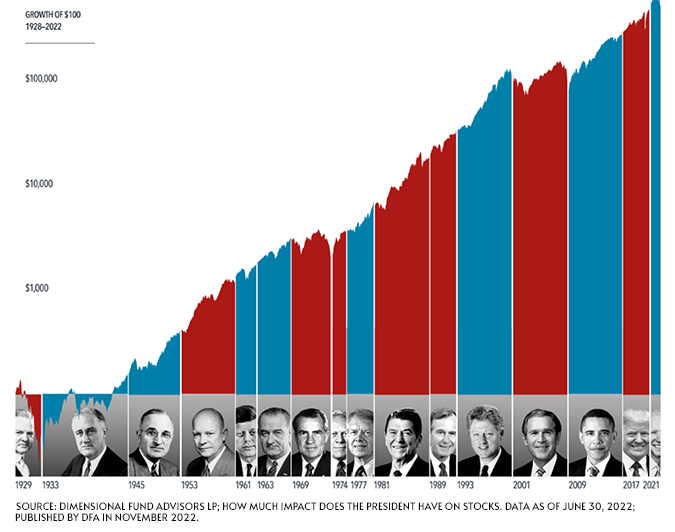

It’s an election year. The commentary will be brutal with folks attacking each other from all angles. Resist the urge to trade based on political wrangling or the fears that opposing sides will thrust into the news cycle. Fear sells. This time may be the outlier, but when you are most fearful, remind yourself that in all Presidential election years since 1940, despite the vitriol, the S&P 500 Index delivered an average return of +9.9% p.a., according to Barrons. Past performance is no guarantee of future results, and there have been Presidential election years that suffered steep losses (2008 during the Financial Crisis is an example), but we see no reason to sell just because our nation will have a robust debate about who should lead us for the next four years.

Over time, it hasn’t mattered. Courtesy of Dimensional Fund Advisors, the following graph demonstrates the growth of $100 invested in the S&P 500 Index starting in Herbert Hoover’s presidency in 1929.

Focus Inflation Abating:

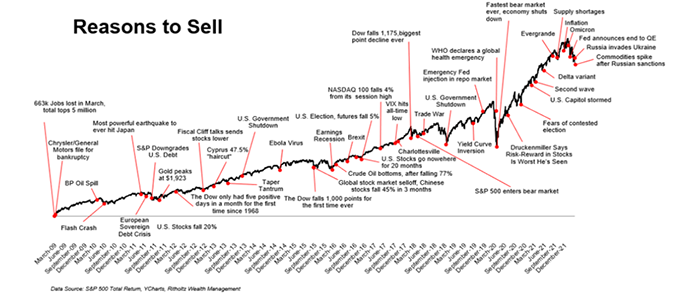

Inflation may continue to ease, as will our collective focus on it. Media will find something else to obsess over. You don’t have to go too far back to remember feeling like we’d never find our way out of trade wars with China, lock downs, and supply chain disruptions. When feeling this way, pull up the below chart from Michael Batnick of Ritholz Wealth Management. He calls it Reasons to Sell. It’s true there were shorter time periods where it seemed wise to be out of the market, but since the 2008 Financial Crisis, the winning strategy has been to remain invested. Go back further and historical returns argue for the same.

The Irrelevant Investor Website- “The Day the Market Bottomed.” Published March 9, 2022.

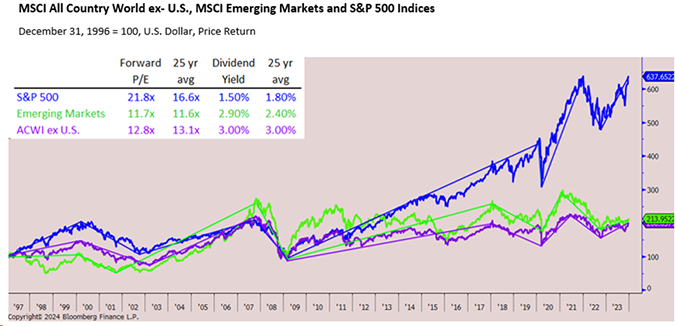

International Equities Are (Still) Cheap:

Look abroad. Stocks of companies headquartered outside of the US continue to be less expensive and offer higher dividend yields than their US counterparts. They should also provide diversification over the long term.

AI:

Artificial Intelligence captivated investors in 2023. Many attribute the success of tech-related stocks in 2023 to this theme. While we are far from experts in this space, we would like to make the following observations. It seems all but certain that developments in AI will improve the productivity of the business community (perhaps at the expense of some jobs in the near-term). But this does not necessarily mean that every company offering AI related services will be terrific investments. Today’s winners may win, but they may also fade away.

The internet made businesses more efficient and changed the world in ways none of us could have imagined at the time. But investors who bought shares of the early “dotcom darlings” such as AOL, Yahoo, JDS Uniphase, Pets.com, Gateway Computers, Netscape, and Prodigy have little to nothing to show for it now. Shares of Cisco Systems—which at one point was the most valuable publicly traded company in the world and remains profitable today—hit $77 per share in 2000 and currently trades below $50 per share (23 years later). AI will change the world (it may already have), but that doesn’t guarantee that an investment in today’s top players will be a profitable endeavor when AI becomes ubiquitous.

Growth at CastleKeep

It was an important year for our firm as Lauren Quesada, who started with us as an intern while at Fairfield University, was appointed Partner in January and Mike Benevento, hedge fund veteran, joined us as a Partner in February. We also are delighted to share that Mary Hackett joined us as Office Manager this fall.

But that is not all. Our now expanded team would like to extend a special welcome to the clients of Alexander Capital Advisors (“ACA”) that officially joined the CastleKeep family in the fall. Tom Paolozzi, the very successful owner of ACA, will assist us and recommend investments. He will also help transfer decades of historical knowledge that will be invaluable to us as we get to know each of the ACA client relationships better.

We look forward to connecting with each of you throughout the year. CastleKeep’s objective is to augment our services and add the very best people to our team as our clients continue to grow in number and in net worth.

On a very sad note, also in 2023, Patty, the beloved spouse of our founder, Charlie, and mom to Partner’s Chuck and Steve, died after valiantly fighting ALS for almost seven years. Her courage and indominable spirit despite the always fatal disease were an inspiration to her family and friends and all who knew her.

2023 was in many ways a year of the unexpected. The world dealt (and continues to deal) with two wars, record setting bank failures, a credit rating downgrade of the US Government, the steepest interest rate hike regime in decades, a recession that never happened, and the removal of the Speaker of the House for the first time in US history. Did anyone predict any of these outcomes twelve months ago? Or that equities would rally in the face of them?

The longer we serve as stewards of our clients’ wealth, the more we are reminded that “normal” is rarely, if ever, “the norm.” Our primary function is to keep clients on the path toward successful outcomes, regardless of the anxiety-inducing headlines that are constantly thrown at us. We feel very good about those efforts in 2023 and thank our clients for entrusting us with that responsibility.

In closing, we’d like to leave you with a quote from Charlie Munger, who just days prior to his 100th birthday, passed away late in the year. Munger served as Vice Chairman of Berkshire Hathaway for decades, having been Warren Buffett’s right-hand man or as Warren has called him “The Abominable No Man.” Munger had a brilliant mind and was gifted with the ability to simplify the complex. It seems that in these times, we need more “Mungerisms” like the following:

A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.

—Charlie Munger, RIP

Sincerely,

The CastleKeep Team

This article as a PDF file: 2023_Year_in_Review

Please see Important Disclosures.