CKBlog: The Market

Tuesday, January 31, 2023

2022 Year in Review

by The CastleKeep Team

The S&P 500 Index suffered its third worst calendar year loss since 1980, dropping nearly 20%. The Bloomberg US Aggregate Bond Index marked its first double digit calendar year loss on record at 13.01%. The often-used 60/40 portfolio breakdown (60% stocks and 40% bonds using the two indexes referenced above), dropped 16%—the third-worst loss for that portfolio style since 1950. It is also the first time in history that both indexes had double digit losses.

In 2022, a sampling of large tech-related growth stocks dropped:

![]()

The staggering losses bled out to other asset classes. Bitcoin, whose supporters believed it to be an “inflation hedge” and “store of value,” lost more than 66% of its “value” in 2022.

If your portfolio is currently intact, congratulations. You survived one of the most challenging market environments on record.

Let’s dig in further to try and understand what happened and what it could mean going forward.

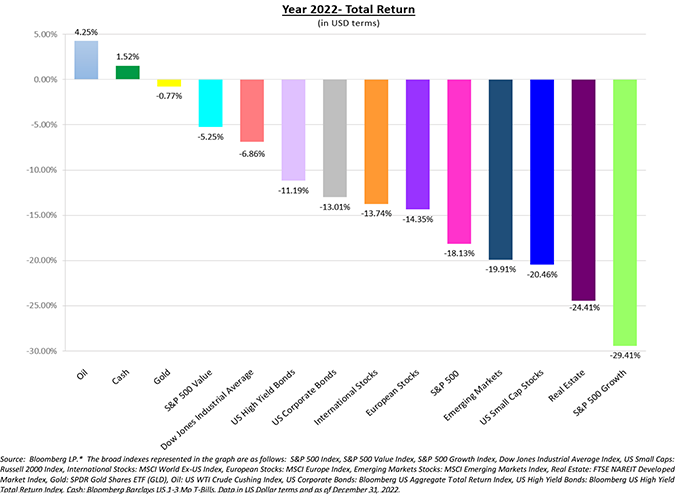

First, check out the annual returns of various asset classes below:

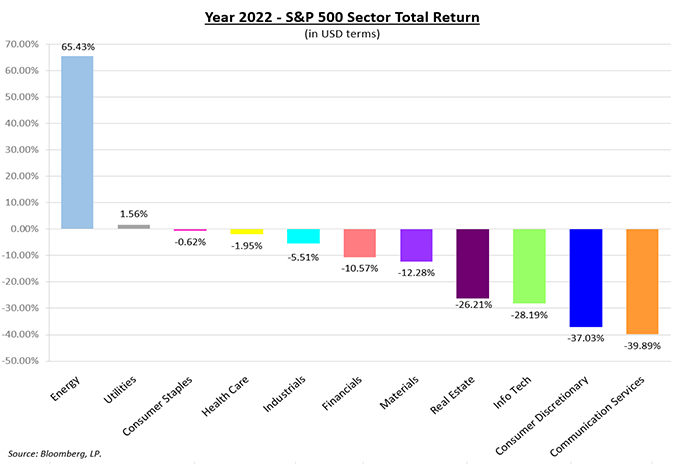

Next, the annual returns by sector within the S&P 500 Index:

Ukraine, Inflation, and Interest Rates

What drove this sharp downturn for most risk assets? It’s impossible precisely to ascribe 2022’s results to one or two events (although most pundits on TV will try to convince you otherwise). We believe it was likely due to the combination of the conflict in the Ukraine, the acceleration of global inflation, and the rapid rise in global interest rates (to combat inflation). But let’s also recall that as we went into January 2022, certain risk assets were at all-time highs, speculation was abundant, and many investors (especially traders) had unreasonable expectations about future returns.

And who can blame them? The S&P 500 Index had more than tripled in the previous ten years. Bitcoin had grown by more than six times in just three years. Homebuyers were paying 25% above asking prices (with no contingencies) and crypto enthusiasts were paying hundreds of thousands of dollars for NFTs (Non-Fungible Tokens) like those of “Bored Apes”. Though impossible to predict when, the writing was on the wall that the markets were due for a reset.

Ukraine

The conflict in Ukraine has sent reverberations across the globe and across global equity markets. It also disrupted the energy complex. WTI Crude began the year trading at $75 per barrel. When news of the invasion broke, the price jumped north of $120 further accelerating inflation fears. As time passed, however, markets adjusted with suppliers adding more oil and gas to meet demand (including from the US government’s strategic petroleum reserve). WTI Crude ended the year trading around $80, representing a muted +4.25% increase year over year. We are following the developments closely but recognize that constructing portfolios based on what Putin may or may not do is not a productive use of time.

Inflation

2022’s spike in inflation has been an issue for both stock and bond markets. Investors are correct to be concerned—the vast majority of whom have never experienced inflation above 2% per annum. This is true for retail and professional investors alike. Charlie, our CIO, recalls attending an event a few years ago where the moderator asked the room full of 100+ investment professionals to raise a hand if they felt that they truly understood high inflation. Out of the entire room, Charlie was one of maybe two people with their hands in the air.

To have lived and invested through periods of meaningful inflation (as in hyperinflation), certainly provides for valuable real-life experiences from which to draw. If you ever wish to learn more about inflation or to have a real talk about it, call us. Charlie can tell you about what it was like to have a mortgage rate of 18% and where it was prudent to invest when inflation was growing at 3% PER DAY while living in Brazil during the late 1980s.

Charlie emphasizes that while inflation is a significant concern, what’s even more concerning are the impacts of inflation embedding in consumers’ daily lives. He remembers friends in Brazil saying, “I don’t need new tires on my car, but tire prices have not increased in two weeks, so I better buy some today because they’ll be more expensive tomorrow ... ” This causes excess immediate demand and eventually causes a severe recession when the music (inflation) inevitably stops—and it is extremely difficult for consumers, companies, and investors to plan anywhere into the future. Global Central Banks are wise to be taking this seriously.

Rising Rates

Indeed, Central Banks have acknowledged the gravity of rising inflation and have begun to combat it by increasing interest rates at a rapid pace. In fact, in the US, we just experienced the largest interest rate increase during a calendar year dating back to 1970. The Bloomberg graph below reflects historical interest rate hikes by the Fed:

We’ve written about how interest rates can affect global markets. In the simplest terms, higher real rates mean more competition for stocks and bonds. They also make borrowing more expensive for individuals and businesses alike. Gone are the days of 30-year fixed rate mortgages at 2.75% during 2021 and early 2022. They approached 7.50% in November. It wasn’t long ago that a small business could borrow for less than 5% on a 10-year term. Today, rates approach 10% for highly qualified borrowers.

Higher rates cause pain for both risk assets and the economy. There has been no greater example of this than over the course of the past 12 months.

Cash and Oil

While very few could have predicted the invasion of Ukraine, many market participants had been sounding the alarm on inflation going into 2022—mostly because of supply chain disruptions and the huge demand for goods that followed the easing of the pandemic. Those concerned about inflation would also be concerned about the impact of higher rates. So why didn’t more investors, including the authors of this piece, heed the warnings?

The two major asset classes that didn’t lose money in nominal terms in 2022 were cash and oil (and certain other commodities). So, with the benefit of hindsight, a profitable strategy coming into the year would have been a combination of cash (which carries inflation risk) and oil-related stocks. But such a portfolio is not prudent, especially for investors with long-term investment objectives. Unless you are a professional investor in the oil space, being heavily allocated to oil is risky. And we’ve learned from the past that while going to cash prior to a major sell-off may seem prescient during a downturn, virtually no one has the skill (luck) to then get back into the stock market at or near the bottom.

You don’t have to go back too far for examples of this. In 2020, during the COVID-19 pandemic, the S&P 500 Index bottomed on March 23, three days prior to the Department of Labor announcing three million jobs were lost in the US the prior week. You couldn’t have created a more pessimistic environment. By the March lows, the S&P 500 Index was down by more than 30%. The very same index finished the year up over 18%. Literally no one could have predicted such a stark reversal.

In our experience, it is easier for investors to sell when fearful, but it’s nearly impossible for investors to get back in at the right time. Markets bottom (and top) when investors least expect it.

Inflation Mitigation

We’ve spent a lot of time considering the impacts of inflation on client portfolios. And while the presence of rising prices isn’t the only input to portfolio construction, we have been making tactical changes to potentially mitigate its impact. After all, portfolios should be designed to increase purchasing power over time.

Whether its screening for companies that have a long history of increasing dividends above inflation, shortening duration on fixed income, or allocating to hard assets like real estate and commodities, there are plenty of tools in the investors’ toolkit to help mitigate the long-term impact of inflation.

But one thing is certain, sitting in cash for decades won’t do the trick.

Buffett Still Has It?

Speaking of cash, Warren Buffett’s Berkshire Hathaway (ticker: BRK/B), despite putting billions of dollars to work last year, is still sitting on a cash hoard of over $100 billion. Whether it was its sizable cash hoard, Buffett’s stock picking prowess, or the tens of billions of cash flow flooding its coffers, Berkshire Hathaway was a rare bright spot within equity markets in 2022. It returned 3.31% during the year, outperforming the S&P 500 Index by over 21%.

Most investors know that Buffett has handily beaten the S&P 500 Index since Berkshire Hathaway’s founding in 1965. But as tech boomed in the 2010s, the chorus of “Buffett Has Lost His Touch” grew loud. Those same folks may be surprised to learn that not only has Buffett more than doubled the annual return of the S&P 500 Index for more than 50 years, but Berkshire also now outperforms the S&P 500 Index over the 1-, 3-, 5-, and 10-year time periods as of December 31, 2022.

Investing Abroad

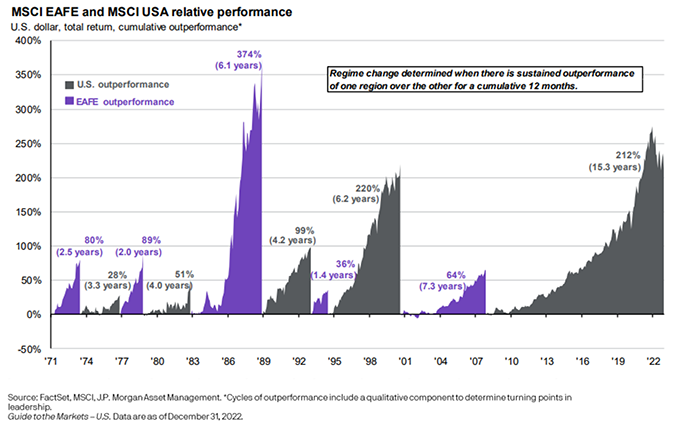

We are strong believers in diversifying portfolios outside of the US. We generally do this through equity funds and ETFs that invest in Europe and Emerging Markets. The investing landscape over the last ten plus years has been characterized by a strong US Dollar and outperformance of technology related stocks. The result being the S&P 500 Index handily outperformed the rest of the world. JP Morgan publishes a chart that demonstrates this well:

While the gray line to the right of the chart (U.S. outperforming) has been the longest duration by far, you will note that its slope began to reverse last year. Why?

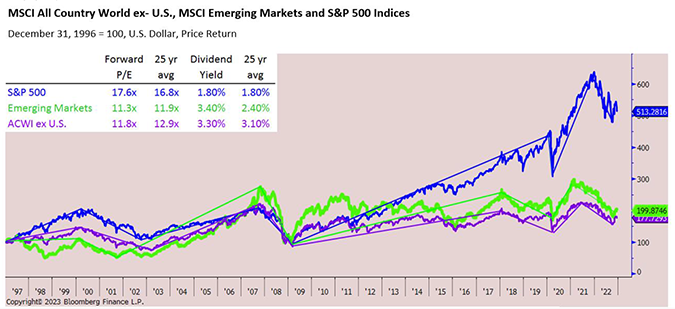

For one, technology stocks have been hit very hard as of late (remember that the market capitalization weighted S&P 500 Index remains heavily tech focused) and the dollar has experienced some weakness. We also believe that global investors are increasingly becoming aware that non-US stocks are generally cheaper by most traditional measures and carry higher dividends than their US counterparts. This is illustrated in the following graph.

Bank on the Banks

Clients and readers of our letters know that we made a tactical decision to overweight US banks in discretionary portfolios during the depth of the global pandemic. We did so despite the collective market having fears that every future crisis would mimic the Global Financial Crisis (GFC) of 2008-9. We didn’t agree that it was necessary at the time. Post GFC, however, the new regulations made bank balance sheets as safe as they have been in decades. In fact, we felt banks would be particularly relied upon to pull us out of the Covid crisis.

Since then, banks in general remain strong and have indeed grown earnings at impressive rates. They still trade well below market valuations, are inexpensive relative to their historic valuations, and sport impressive dividend yields. Our conviction remains, even if we enter into a recession in the near-term.

Other tactical changes we made in 2022 for discretionary portfolios included:

- Reduced the duration within fixed income allocations.

- Allocated to Business Development Companies (which extend floating rate credit to middle market companies).

- Allocated more of the portfolio to single stock names (which we feel are undervalued).

We have maintained our tactical exposures toward value-oriented stocks (including Berkshire Hathaway), energy via pipeline companies, and non-US stocks. We maintain a reduced exposure to speculative growth stocks and technology names.

2023 and Beyond

We are the first to admit we have no ability to accurately forecast what markets will do in the short term. So rather than make predictions, we offer themes to focus on in 2023.

Fed Pivot?

If you read the Wall Street Journal or turn on CNBC, you are well aware that the Fed has been increasing interest rates at a rapid pace and has pledged to continue doing so. While it is useful to read and listen to what Fed Governors are writing and saying, we wouldn’t take it as gospel. Why? They have a history of changing course. Sometimes drastically. Things change.

We wrote about Fed Chair Powell’s famous pivot in 2018-2019 in our third quarter 2022 review. Below is the impact and timing on the Fed’s pivot on the S&P 500 Index at that time:

If you took the Fed Governors at their word and expected more pain going into 2019, you would have missed out on a dramatic rebound in the market.

We’ve seen a more recent pivot that resulted in even more pain. Rewind roughly one year back to Powell’s official Fed statement on December 15, 2021 (Federal Reserve FOMC Transcript of Press Conference on 12-15-21).

“ ... The median projection for the appropriate level of the federal funds rate is 0.09% at the end of 2022 ... ”

Instead, just months after this statement, Powell and his committee raised rates at the fastest pace on record. The Federal Funds rate closed 2022 at 4.25%-4.5%, more than 400% higher than they projected in December 2021! Risk assets promptly entered a bear market. Pay attention to what the Fed says, just don’t take it as gospel.

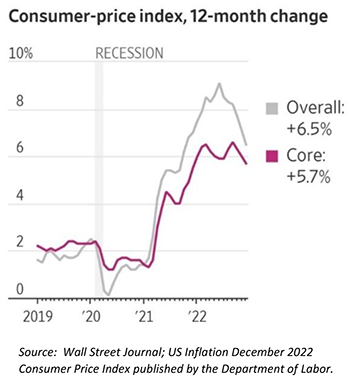

Inflation Slowing?

Inflation will no doubt continue to dominate the headlines. Recently, there is compelling evidence that inflation may be slowing. The graph to the right is from the Wall Street Journal on January 13th, 2023, after the Department of Labor’s December CPI print.

Inflation will no doubt continue to dominate the headlines. Recently, there is compelling evidence that inflation may be slowing. The graph to the right is from the Wall Street Journal on January 13th, 2023, after the Department of Labor’s December CPI print.

It’s important to note that this doesn’t mean overall prices are falling, however, they are just rising less. We don’t know what the CPI may do in 2023, therefore we will continue to focus on building portfolios that we believe should be resilient to pricing pressures over time. After all, today’s CPI matters far less than the purchasing power your portfolio will afford you 10 or 20 years from now.

Soft Landing versus Recession?

There is great debate as to whether the actions of the Fed will trigger a recession or whether the economy is resilient enough to sustain growth despite higher interest rates. We remind investors that unfortunately, recessions are a normal part of economic cycles. In fact, according to the St. Louis Federal Reserve Bank, the US has experienced eight recessions since 1967—on average once every seven years. Instead of attempting to time investments based on whether or not we are due for a recession, investors should recognize that recessions are a healthy—yet painful—part of the economic cycle. The best athletes in the world need breathers from time to time. So, too, does our economy.

Furthermore, we just don’t know whether the economy is in recession and how severe the recession is until after it’s over. By then, the economy by definition will be growing which will likely already be reflected in the stock market. History tells us it’s very difficult, near impossible, to time these things.

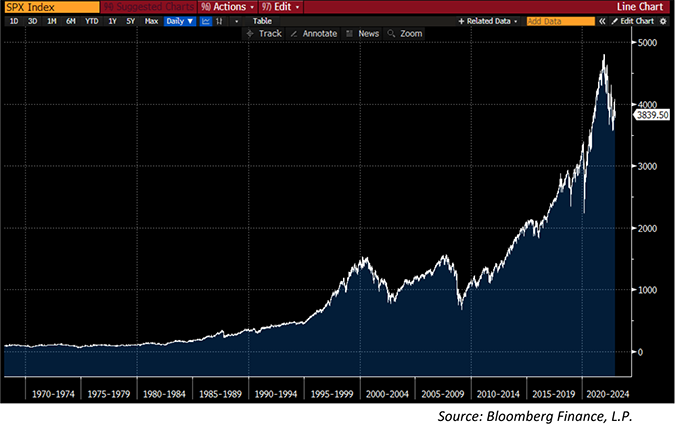

The S&P 500 Index closed 1967 at $96.47. It ended 2022 at $3,839.50. Through eight recessions, the S&P 500 Index compounded at a +10.05% annual return for 55 years. Here it is in visual form:

Stay the course, regardless of macro prognostications.

Thank You

2022 was a challenging year for investors. We take the privilege of being entrusted to manage clients’ hard earned nest eggs very seriously—especially during turbulent times. We remain as grateful as ever to help you navigate through this environment. Thank you for your trust and confidence.

Sincerely,

The CastleKeep Team

January 31, 2023