CKBlog: Strategies

Monday, May 06, 2019

Berkshire Meeting Notes

by Steve Haberstroh, Partner

This year’s Berkshire Hathaway’s Annual Shareholder Meeting ended and I wrote down the following to summarize the day:

Read a ton. Never stop learning. Be patient. Surround yourself with great people. Do what you think is right. And do it all over again.

The message is the same as it ever was.

To me, that’s the beauty of making the trek to Omaha. Markets change. Politics change. But each year, Warren Buffett and Vice Chairman Charlie Munger stay on message and remind us to tune out the considerable static, do our homework, and act with conviction when the odds are in our favor.

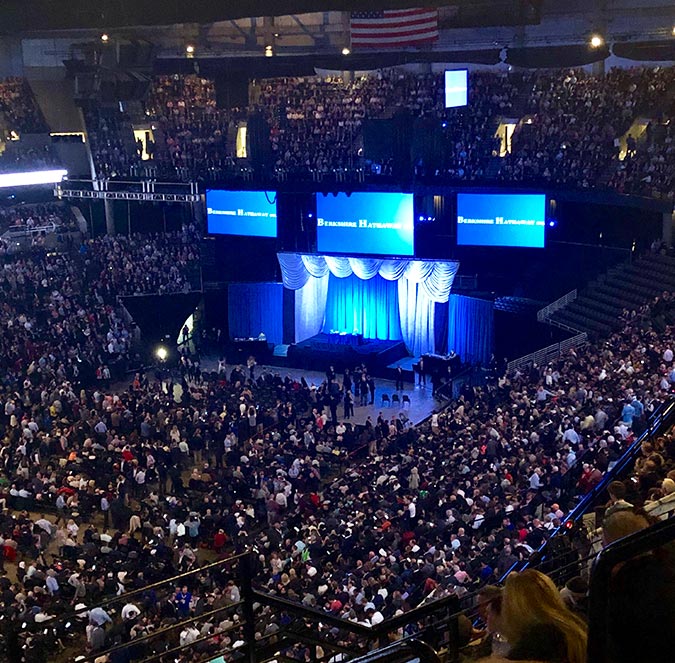

And while their message has not wavered, this year’s meeting featured one major change. Whether by design or not, recently named Vice Chairmen Greg Abel and Ajit Jain were each handed the microphone twice to answer questions from shareholders. Normally, Buffett and Munger are the only ones addressing the 40,000 people in attendance. This was a first, and highlighted that Buffett and Munger are eager to roll out a smooth succession plan. After all, they are 88 and 95 respectively. Their track-record may be god-like, but last I checked they are not immortal.

Attendance at the 2019 meeting was one for the record books.

Other Notes from the Meeting

- This was a record-breaking year for attendance and for sales at Berkshire subsidiaries who sell their wares in the adjacent convention center during the weekend.

- Buffett highlighted that the Nebraska Furniture Mart did $9.3 million in sales the day before the Annual Meeting. He also noted the company started with $2,500 and Berkshire never added a dime in capital.

- There were many questions about Berkshire stock buy-backs. Shareholders clearly are growing impatient with the pace of buy-backs (roughly $1.4 billion in the first quarter) given Berkshire’s $114 billion cash hoard. Buffett noted he believed shares are fairly priced but not a substantial bargain at today’s price.

- Buffett has considered investing their cash hoard in the S&P 500 Index while they wait for deals and said it may be a good strategy for his successor as well. But he and Munger like cash during times of panic. He also suggested his successor may decide to return cash to shareholders in the form of dividends.

- Buffett lauded the recently announced $10 billion preferred equity financing deal with Occidental Petroleum where Berkshire will be paid an 8% yield and receive warrants for up to 80 million shares of Occidental for $62.50 if its takeover of Anadarko Petroleum closes. He also used it as a marketing opportunity saying, “If anyone else needs $10 billion in two days, they’ll think of Berkshire.” He was proud to announce the deal was struck within one hour.

- Buffett estimates PE firms have over $1 trillion in uninvested cash thereby is bidding prices up for private companies. This, along with historically low interest rates and covenant-light debt is making it hard for them to find undervalued private businesses.

- Buffett and Munger believe PE fee structures incentivize poor behavior. “It’s not in our shareholders’ best interest to act like them.” Munger

- Buffett, under his breath, reminded Munger that they almost did a huge deal in China recently. They spent a lot of time talking about China and believe there is great opportunity to invest there. As Munger put it, “We have bought things in China and my guess is we will buy more.”

- Buffett and Munger agree they paid too much for Kraft-Heinz.

- Buffett believes you cannot learn about human nature by just reading books. It takes real life experience.

- Buffett and Munger continue to regret “missing out” on Amazon and Google.

- As your investment fund grows, it is harder to generate outsized returns compared to a benchmark like the S&P 500 Index in Berkshire Hathaway’s case.

Classic Buffett & Munger Quotes from the Meeting

“Lose money for the firm and I will be understanding. Lose a shred of reputation for the firm and I will be ruthless.” Played on the intro video every year, Buffett’s statement testifying before Congress in the wake of the Solomon Brothers scandal in 1991.

“We will buy stock when we believe it is selling at a conservative value below its intrinsic value ... it’s very simple. We are ok buying it but we aren’t salivating over it.” Buffett

“If a bank needs government assistance, the CEO and their spouse should lose their net worth.” Buffett

“I’m a card carrying capitalist. You don’t have to worry about me changing in that way.” Buffett

“We don’t want the stock to trade abnormally high. We are probably unique in that way. We don’t want the stock trading twice than it’s worth because then I’m going to disappoint people.” Buffett

“You can pay too much for a business. The business does not know what you are paying for it.” Buffett

“We’ve seen extraordinarily high-IQ people destroyed by leverage.” Buffett

“I asked a hedge fund manager why in the world he can charge 2 and 20 and he said ‘cause they wouldn’t pay 3 and 30’.” Buffett

“I don’t beat myself over not buying Amazon. He’s a bit of a miracle worker and it’s peculiar. But I feel like a horse’s ass for not buying Google.” Munger

“It’s awkward being different but I don’t want to be like everyone else ‘cause we just do it better. So you’re just going to have to endure us.” Munger

“If the world goes into hell in a handbasket, you people are with a good company ... And if the world doesn’t go into hell in a handbasket, is it all that bad?” Munger

“Don’t take people that have expectations of you that you can’t meet ... make sure you are in sync with each other.” Buffett on managing other people’s money.

“In my family the last thing they’d give up is their Apple phone.” Munger

What do you value most in life today? Munger: “I’d like a little more it.” Buffett: “Time and Love.”

On investing in technology, “We don’t want to play in a game we don’t understand ... we have missed a lot in the past and we will miss a lot in the future.” Buffett

Munger on specialization: “Nobody wants to go to a doctor that’s half proctologist half dentist.”

On whether Berkshire can expect to continue to compound value like they have in the past, Munger says “Well we came a very long way from small beginnings so the fact that we may slow a little doesn’t strike me as a tragedy ... we are going to do very well over time.” Munger

“It’s very disappointing. We have no formulas at Berkshire.” Buffett

On business and life partners, “The secret is to find the best person who will have you.” Munger

“Think about how much we’ve learned over the years. At any given time what we already knew wasn’t enough to take us to the next level.” Munger

I personally own shares of Berkshire as do many of our clients.

If you’d like to discuss the weekend further, I can be reached at .(JavaScript must be enabled to view this email address)